Industry Trends

Marketing Insights

Each year, the BUILDER Brand Use Study surveys approximately 1,000 homebuilders and residential general contractors about their familiarity with, use of and opinions of brands across more than 50 product categories. In recent years, sponsor Hanley Wood, a media firm focused on commercial and residential construction, has conducted a similar survey in some categories among remodeler contractors.

Together, the two reports total 1,019 pages. Not exactly a summer read, but that’s why we boiled it down for you.

Here are a few highlights from the BUILDER Brand Use Study.

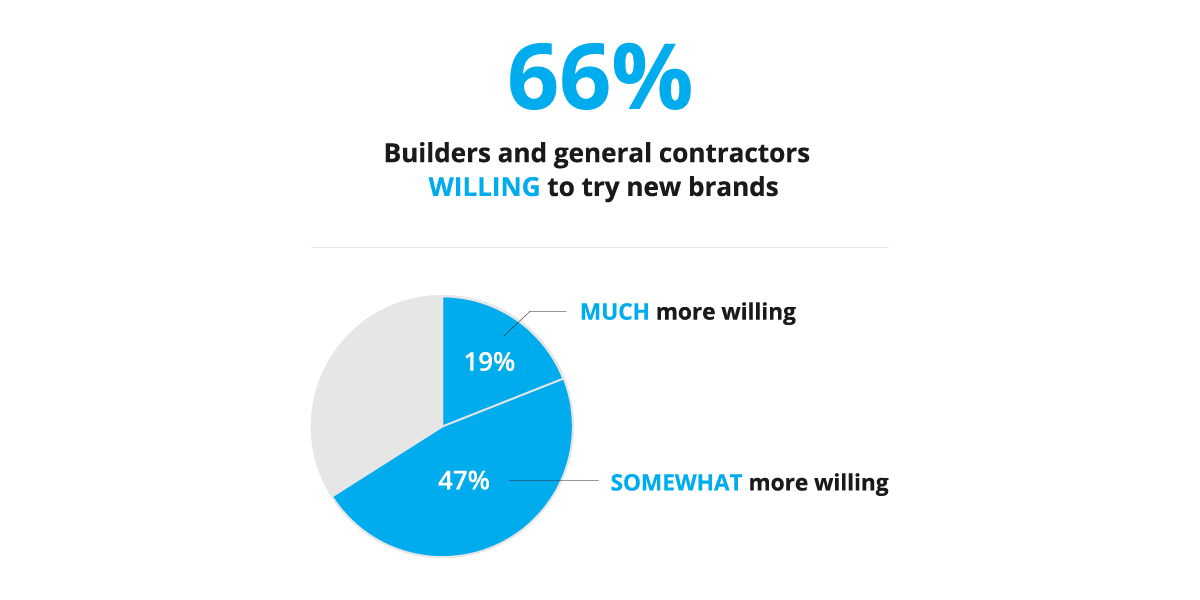

- Of ALL builders and general contractors, 66% are willing to try new brands, emphasizing an opportunity for challenger brands to gain market share.

- At 58%, builders at the lower end of the sales price scale (under $150K) are less willing to try new brands, likely due to their need to control costs. In other words, they don’t have the flexibility of their counterparts building at higher price points.

- Of ALL builders, 77% count advanced or new product features as the top reason for willingness to try new brands.

- Custom builders of homes priced $500K-plus are even more drawn to advanced or new product features, with 82% calling it the top reason to change. Distinction, not cost control, is this cohort’s primary motivation.

- As decision drivers, price and quality come in far behind product features, with half of builders keen on price and 47% focused on quality. Did I hear someone say innovation is a growth driver?

- Nearly 75% of builders say they (and not the homebuyer/owner or architect/designer) make final decisions on brands. While this varies by product category, one thing is clear: if you want your brand to win in the homebuilding sector, you have to have the builder in your camp.

But what’s driving the numbers?

No one has a definitive answer, but we can craft an educated hypothesis.

Technology touches every aspect of life, so surely technology is also driving more product development, innovation, materials that make manufacturing cheaper and more efficient, ideas that make more money and products that make the marketplace greener. In fact, my gut tells me technology is No. 1.

Taking it a step further, we’re absolutely witnessing a collective mindset shift. Think about all the forces at work in the home and building industry today, from smart homes and technology to healthy homes and green practices. All of these foster new products — and I have to believe that as consumers continue to get exposed to new options, eventually many of them will say, “Gee, I guess I should try it."

Generational differences may play a role, too. For example, as more millennials enter the marketplace, they could be driving increased demand for new products. Or, builders could be aging down (versus the perennial old-school population that’s always quick to say, “That’s just how we’ve always done things”).

Here’s how to get builders in your brand camp.

This is a big subject, but I’ll make it simple.

From Instagram to the International Builders’ Show floor, make sure you address meaningful benefits for your customers. You can talk about product features all day, but what’s in it for your customers? You have to reach builders with meaningful education (not exactly how fast or powerful the product is, but how it will make their jobs and lives easier and make their business more profitable). And, you have to share content when and where they want it (often via mobile and online channels).

Have questions about the survey results? Want to dig deeper? Send us a note.